In March 2013, McGraw-Hill closed the sale of its education business to Apollo, a private equity company for $2.4 billion in cash. In the nine months before the sale was announced, the company had achieved a 15.8% operating margin, while EBITDA in 2013 was negative (making any multiple not meaningful).

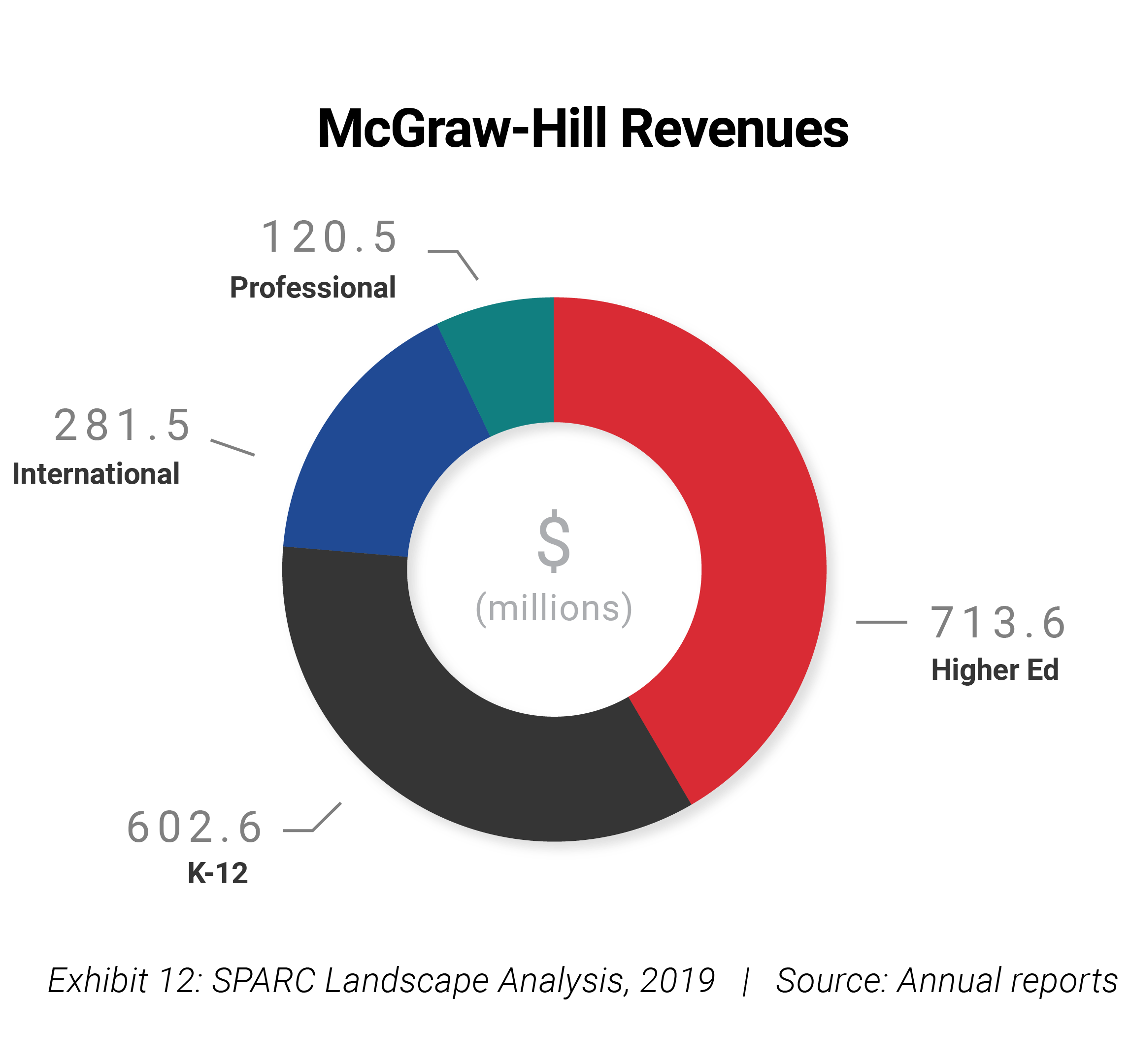

McGraw-Hill Education operates across higher education, K-12, and professional markets, but is very dependent higher education, which accounts for 41.5% of its revenues (Exhibit 12). The company exited the assessment business in 2015, effectively going in the opposite direction of Pearson, which has decided to abandon K-12 courseware and stay in assessment.

Apollo has hoped for a long time to IPO the business to exit the investment. Net debt at the end of 2017 stood at $1.832 billion, implying a net debt/EBITDA ratio of 8.5x. An IPO that would raise fresh funds and pay down debt would be quite a relief to management, but so far has proven impossible to pull off. The company filed papers in 2015 and again in 2016, but market conditions have prevented Apollo from carrying out this step. The company has spent about $700 million in technology since Apollo acquired it, and this demand on its cash flow shows in the net debt, which peaked in 2016 at $1.927 billion, rising from $1.242 billion at the end of 2013 (the year of the acquisition).

Exhibit 12

Higher Ed accounts for 41.5% of McGraw-Hill Education revenues